Forex trading is an exciting and dynamic market that operates 24 hours a day, five days a week. For those new to the concept, forex trading basics https://forex-level.com/ provides valuable resources to help you embark on this journey. In this guide, we will explore the fundamentals of forex trading, the mechanics behind it, key terminology, and effective strategies to enhance your trading skills.

What is Forex Trading?

Forex, short for foreign exchange, involves the buying and selling of currencies in the global market. Unlike traditional stock markets, forex operates without a centralized exchange. It is the largest financial market in the world, with daily trading volumes exceeding $6 trillion. The market is decentralized and operates via a network of banks, financial institutions, corporations, and individual traders.

How Does Forex Trading Work?

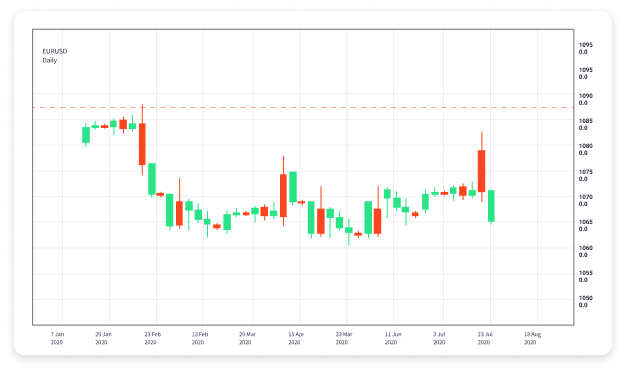

Forex trading involves currency pairs, meaning you are always buying one currency while selling another. Each currency pair consists of a base currency and a quote currency. For example, in the pair EUR/USD, the Euro is the base currency, and the US dollar is the quote currency. The price of a currency pair reflects how much of the quote currency is needed to purchase one unit of the base currency.

Key Concepts in Forex Trading

- Leverage: Forex trading allows traders to use leverage, meaning they can control a larger position with a smaller amount of capital. This amplifies both potential profits and risks.

- Margin: The margin is the amount of money required to open a leveraged position. It is expressed as a percentage of the full position size.

- Pips: A pip (percentage in point) is the smallest price move in a currency pair. Most pairs are quoted to four decimal places, so one pip is 0.0001.

- Spreads: The spread is the difference between the bid price (selling price) and the ask price (buying price) of a currency pair. It is how brokers make money.

Types of Forex Orders

Understanding different types of forex orders is crucial for effective trading. Here are the most commonly used order types:

- Market Order: An order to buy or sell a currency pair at the current market price.

- Limit Order: An order to buy or sell a currency pair at a specified price or better. A limit order acts as a protective mechanism to ensure you do not enter the market at an unfavorable price.

- Stop-Loss Order: An order to automatically close a position at a predetermined price to limit potential losses. This is crucial for managing risk.

- Take-Profit Order: An order to close a position when it reaches a specific profit level. This locks in gains without needing to manually monitor the market.

Basic Analysis Techniques

To succeed in forex trading, understanding market analysis is vital. There are two primary forms of analysis:

Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, interest rates, and geopolitical events. Key economic reports such as GDP growth, employment data, and inflation rates can have significant impacts on currency values. Traders analyze these factors to predict currency movements and make informed trading decisions.

Technical Analysis

Technical analysis focuses on historical price data and market trends to forecast future price movements. Traders use various tools, such as charts, indicators, and patterns, to analyze price movements. This method relies on the belief that historical price action reflects market psychology and can be used to identify potential entry and exit points.

Managing Risk in Forex Trading

Risk management is a crucial component of successful forex trading. Here are some essential strategies to consider:

- Use Stop-Loss Orders: Always set stop-loss orders to limit potential losses on every trade.

- Limit Leverage: While leverage can amplify profits, it can also increase losses. Use a leverage ratio that aligns with your risk tolerance.

- Diversify Your Portfolio: Avoid putting all your funds into one currency pair. Diversification can reduce risk by spreading exposure across different currencies.

- Start with a Demo Account: Using a demo account can help you practice trading without risking real money. It allows you to test strategies and build confidence.

Tips for Beginners

Here are some useful tips for novice forex traders:

- Educate Yourself: Take advantage of online courses, webinars, and trading forums to deepen your understanding of the forex market.

- Develop a Trading Plan: Create a solid trading plan that outlines your goals, risk tolerance, and strategies.

- Be Patient: Forex trading requires time and practice to master. Avoid rushing into trades, and be prepared for losses.

- Stay Informed: Keep up with global news and economic events that may affect currency movements.

Conclusion

Forex trading can be an exhilarating venture for traders willing to invest the time and effort to learn its complexities. By understanding the basics of how the forex market operates, employing effective strategies, and managing risks, beginners can set themselves on the path to becoming successful traders. Remember that like any investment, trading in forex carries risks, and it’s essential to trade responsibly and continue learning as you progress.