Understanding Overnight Fees on PrimeXBT: A Comprehensive Guide

In the world of trading and investing, understanding the costs associated with your trading activities is crucial for making informed decisions. One such cost that traders need to consider are the Overnight Fees on PrimeXBT overnight fees on PrimeXBT. These fees, also known as swap rates or rollover fees, can add up over time and significantly impact your trading profitability, especially if you’re engaging in leveraged trading or holding positions overnight. In this article, we’ll delve deep into the concept of overnight fees on PrimeXBT, how they are calculated, and strategies to mitigate their impact on your trading capital.

What are Overnight Fees?

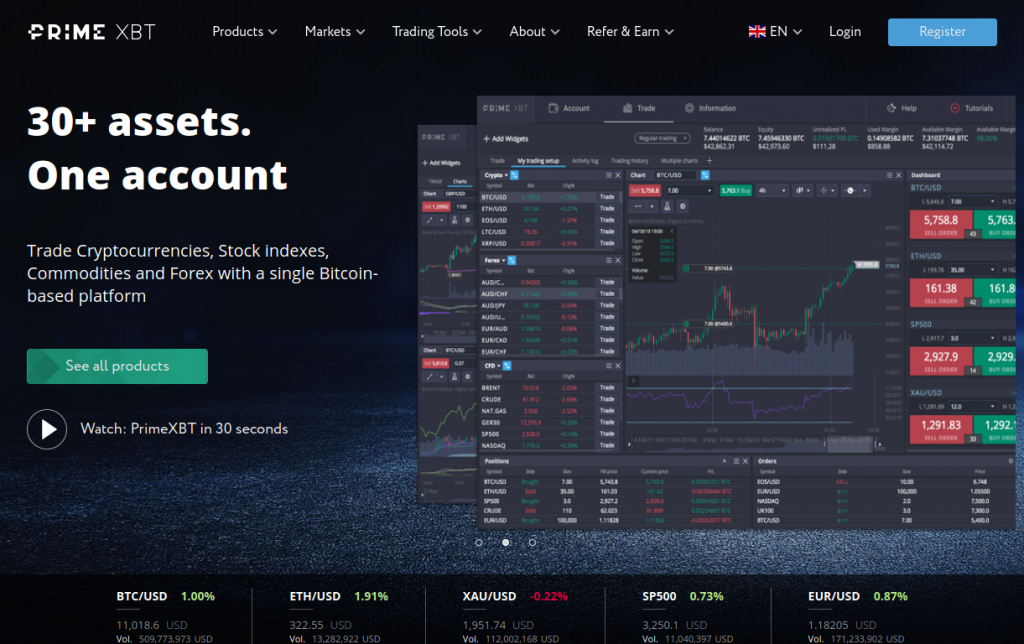

Overnight fees are charges that traders incur when positions are held open after the market closes for the day. They are typically determined by the difference in interest rates between the two currencies involved in a trade and can vary throughout the week. In the context of PrimeXBT, these fees apply to margin trading on various assets, including cryptocurrencies, commodities, and forex pairs.

How Overnight Fees Work on PrimeXBT

When a trader opens a leveraged position on PrimeXBT, they essentially borrow funds for their trade. The broker charges interest on this borrowed amount, which translates into the overnight fees. Here’s how it works:

- Position Type: The type of asset you are trading can influence the overnight fee. Different assets have different interest rates, which can lead to varying fees.

- Trade Size: The larger your position, the higher the overnight fee since it is often calculated per unit of the asset.

- Holding Period: If a position is held overnight, the trader will incur the overnight fee once daily at a specific time. On PrimeXBT, this is typically at 00:00 UTC.

Calculating Overnight Fees

The calculation of overnight fees on PrimeXBT can vary depending on several factors, but the basic formula generally includes the following:

Overnight Fee = (Position Size × Fee Rate × Number of Days) / 365

Where:

- Position Size: The total value of your trading position.

- Fee Rate: The interest rate applied to your position, which can vary based on market conditions.

- Number of Days: The number of days the position is held overnight.

Traders should keep in mind that weekend fees may also apply, typically being charged at a higher rate because you are charged for the entire weekend — two days instead of just one.

Why Do Overnight Fees Matter?

Overnight fees can significantly affect the profitability of your trades, particularly for long-term positions. For example, if a trader frequently holds trades overnight, the cumulative effect of these fees can eat into their profits or exacerbate their losses. Understanding these fees enables traders to:

- Manage Costs: By being aware of overnight fees, traders can more accurately calculate their potential expenses and profits.

- Plan Trading Strategies: Traders may choose to close positions before incurring overnight fees or look for assets with lower fees.

- Avoid Surprises: Being informed prevents unexpected charges from occurring, allowing for better cash flow management.

Strategies to Manage Overnight Fees

To enhance your trading experience and minimize the impact of overnight fees, consider the following strategies:

- Close Positions Before End of Day: If you’re trading short-term, aim to close your positions before the designated rollover time to avoid overnight fees.

- Choose Low-Fee Assets: Research and select assets that have lower overnight fees, which can help in reducing your overall trading costs.

- Use Alerts: Set up alerts for your positions to ensure you don’t forget to close them before incurring additional fees.

- Plan Your Trades: Have a clear trading plan that considers potential overnight fees and incorporates them into your risk assessment.

Conclusion

In conclusion, overnight fees on PrimeXBT are an essential aspect of trading that should not be overlooked. By understanding what these fees are, how they are calculated, and why they matter, traders can take proactive steps to manage them effectively. Employing strategies to minimize overnight fees can help enhance trading profitability and contribute to a more fruitful trading journey. As always, continuous education and awareness of market conditions and trading platform details will equip traders to make more informed decisions and optimize their trading strategies in the ever-evolving financial landscape.